2024 turned into a much stronger year for the housing market than many anticipated, with a return to house price growth. This year looks set to continue in a very similar way with continued stronger levels of market activity and solid price growth.

Economic growth expectations

Whilst economic growth expectations have moderated a little for 2025 (the Bank of England recently cut its GDP forecast for the year to 0.75%), the economy is still expected to grow and growth levels should be sufficient to drive moderate house price growth. Beyond 2025, current economic forecasts point to stronger year next year, with economic growth momentum picking up speed. With a few conflicting signals the Bank of England will likely take a slow and measured approach to further interest rate cuts, but forecasts suggest there is scope for further rate cuts. The consensus forecast for year end is 3.75%.

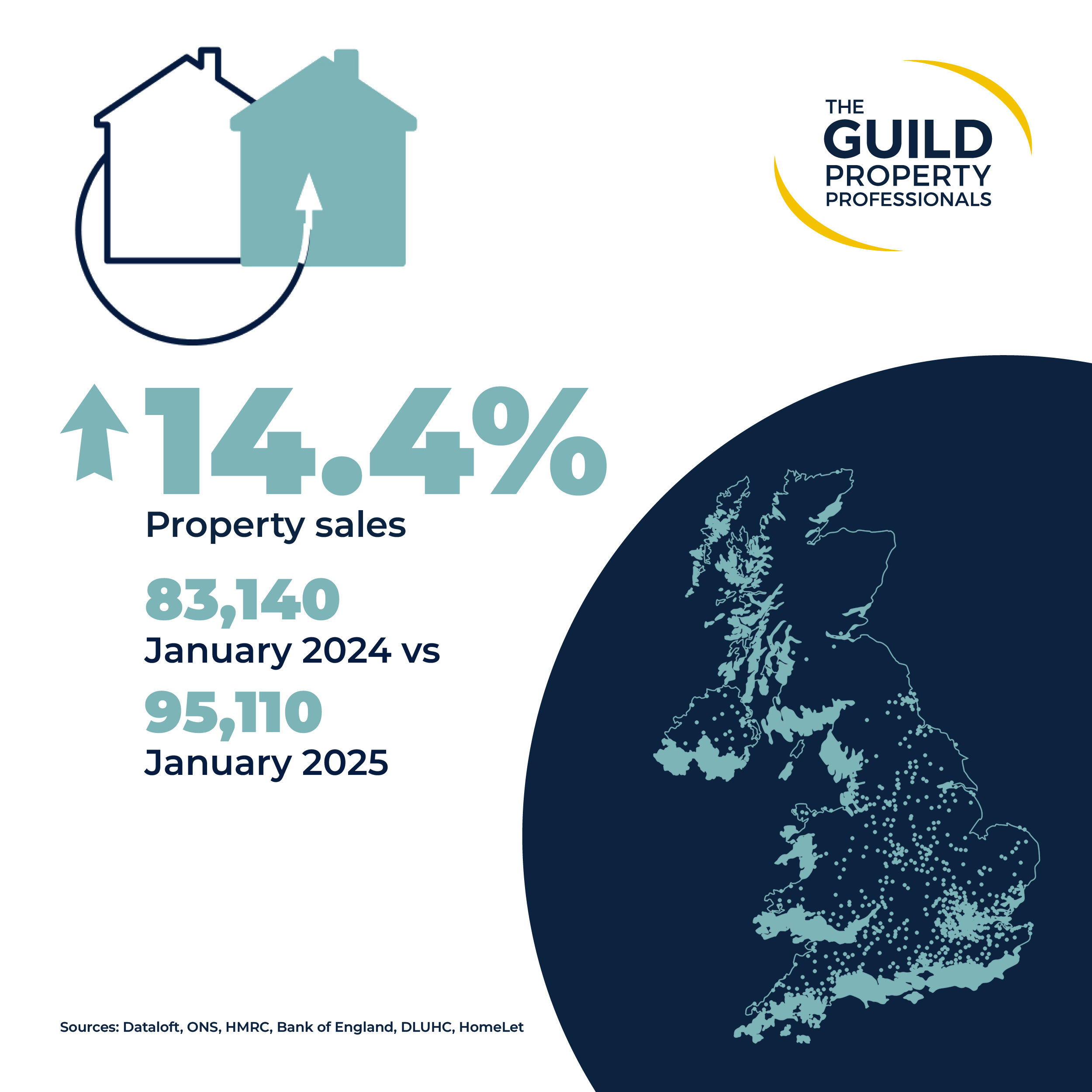

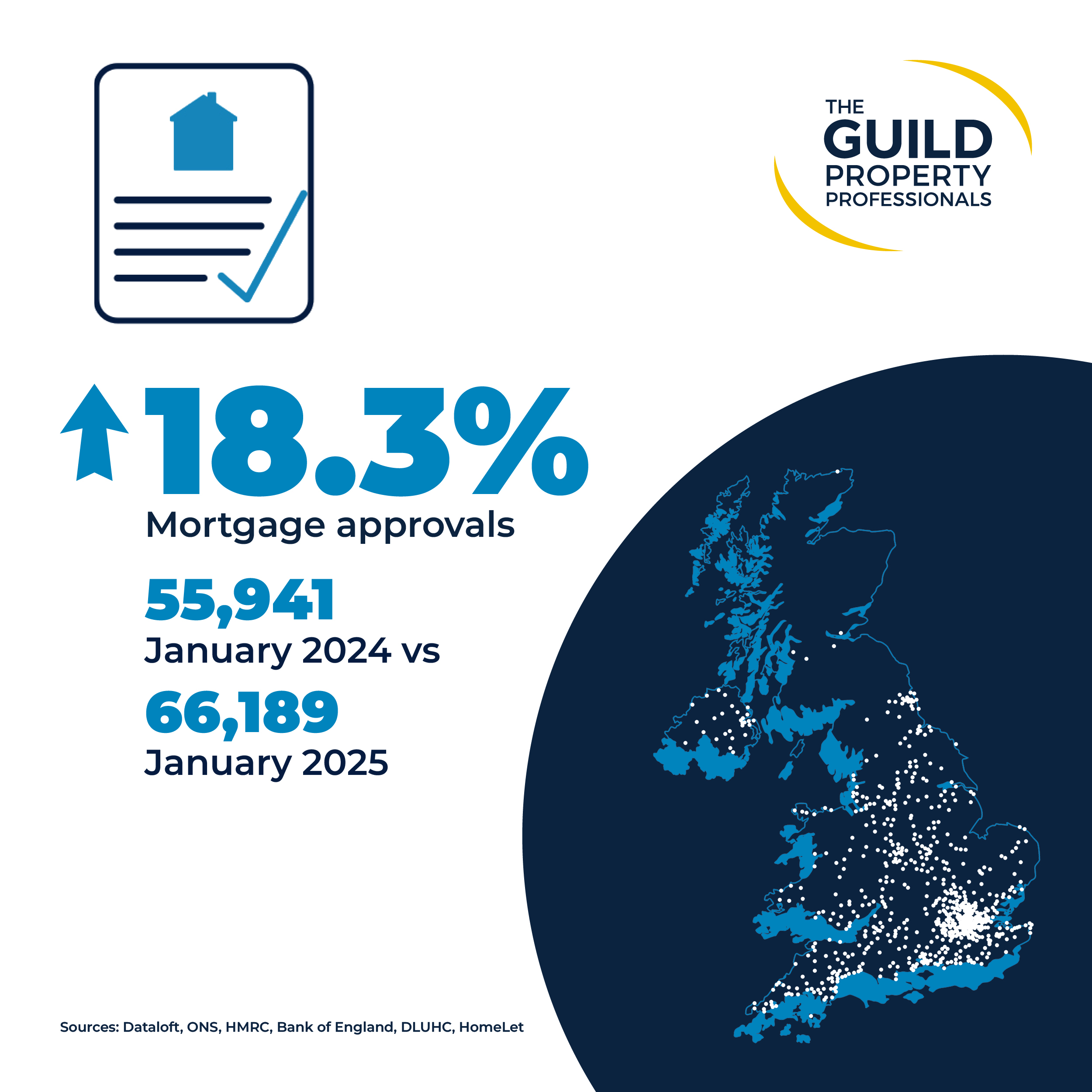

Sales volumes recovery

Sales volumes suffered through much of 2023 and early 2004, what is evident now in the market is a recovery to normal levels of activity. The latest month sales volume for the UK* reported 88,200 monthly sales – broadly in line with the levels of activity in the market for the 5 years prior to covid. Mortgage approvals, which are the front runner to transaction activity, have also recovered to long-term trend levels. Latest monthly data** was 66,500 exactly the same as the monthly average for the 5 years to end 2019 (pre covid).

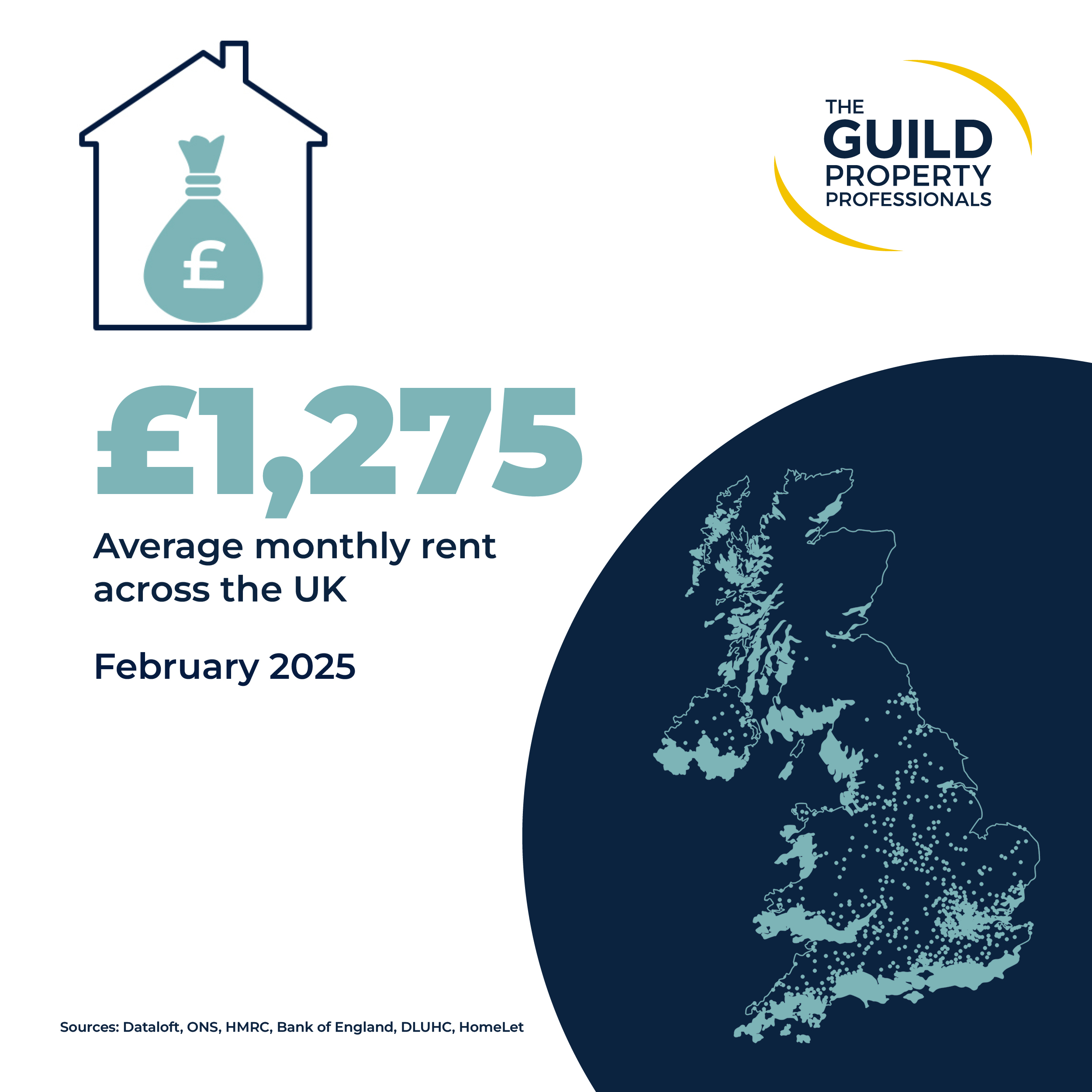

Slower pace of rental growth

The last few years have seen exceptional levels of rental growth, this pace is now slowing but rents are still expected to grow. In the year to end February rents were 1.0% higher than they were a year ago with a median rent level of £1,275. Tracking back the performance of the rental market, this time last year the growth rate was 7.4%. With mortgage rates improving, there has been a resurgence in first-time buyer activity, helping take some pressure off the rental sector. With such a tight market over the last few years, many renters decided to sit tight and renew, with potentially less competition per rental property this year, there might well be increased level of activity as more renters feel more confident to move on.

First time buyer numbers recover

The number of first-time buyers in 2024 was 19% above 2023 levels. This is due to improving affordability as mortgage rates fall as well as the looming deadline for the reversal of the stamp duty exemption for first-time buyers. The proportion of first-time- buyers versus other borrowers* was the highest since the data series commenced in 2007 at 29%. Conversely, the proportion of buy-to-let mortgages within new lending was one of the lowest (at just 8%).

Underlying affordability

The mortgage data gives insight into the underlying affordability of the market. The majority (65.3%) of new mortgage borrowers apply on a joint income basis, in line with the average over the last 15 years (62.2%). Likewise, there hasn’t been a discernible shift in the loan to value rates on new mortgages, the latest data shows that 59% of new lending was less than 75% loan-to-value, which is very similar to 61% average over the last 15 years.

*other owner occupiers and buy-to-let

National market overview

Overall UK prices grew by 4.6% in 2024. The strongest growth was from Northern Ireland, Scotland and the North East. In these regions with lower average pricing, there was more headroom in affordability to help absorb the increase in mortgage rates over the last couple of years.

With mortgage rates improving and continued strong earnings growth also a boost to affordability, price growth is expected to be maintained over 2025 and expensive regions like London should see start to feel the benefit of improved affordability. Consensus UK forecasts suggest that price growth will be 3.1% for 2025 and 3.7% the year after.

View all our Regional Market Reports for Spring 2025

– Wales

– London

– Scotland

– Southern – Isle of Wight, Dorset, Hampshire, Wiltshire

– South East Home Counties, Kent and East Sussex

– Thames Valley, Berkshire, Oxfordshire, Buckinghamshire

– Herts, Beds and Cambridgeshire

– North East, Yorkshire and the Humber

Contact us

Sell your property with your local expert this season. Contact your local Guild Member today.